GBP/JPY Neutral Outlook Unchanged for Now

GBP/JPY

+0.94%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GBPJPY_21_07_daily

GBPJPY_21_07_daily

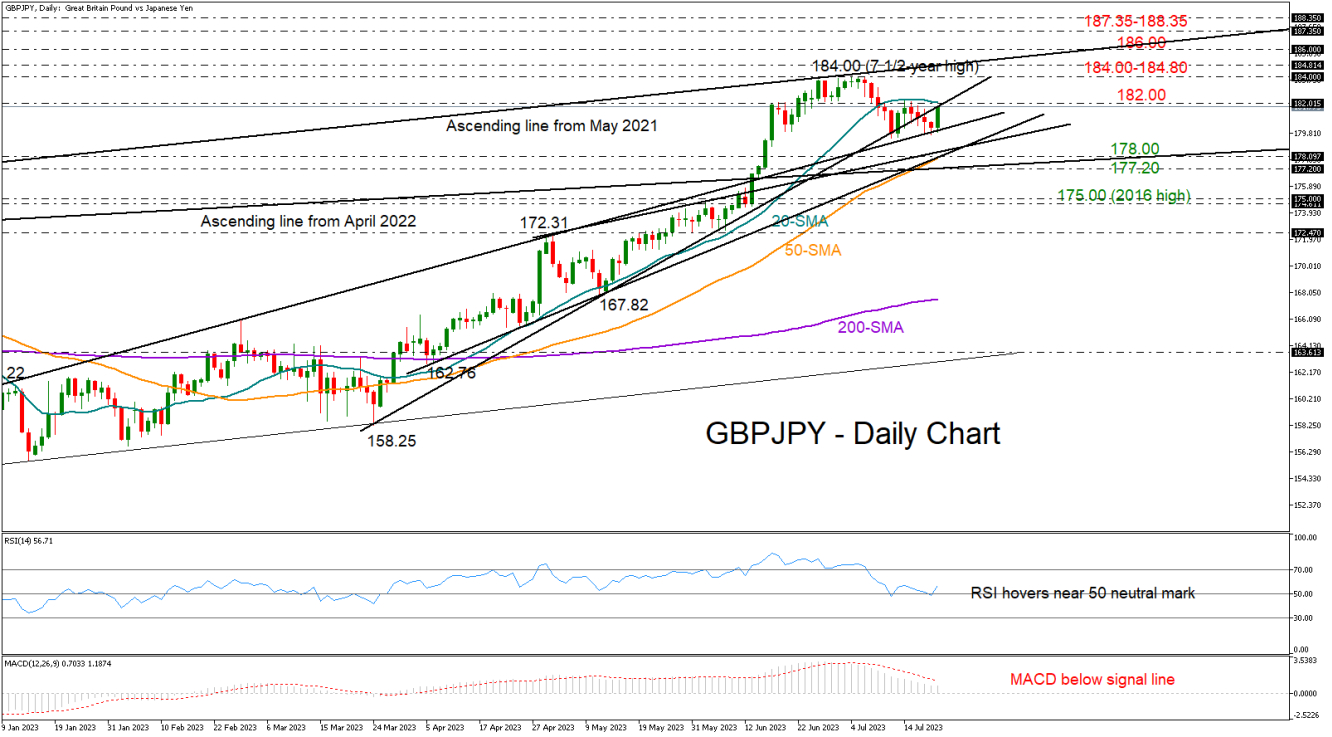

GBPJPY drifted back higher to retest its 20-day simple moving average (SMA), which capped last week’s recovery attempt around 182.00.

The price gained positive momentum early on Friday after touching the lower boundary of the one-month-old range and the broken 2023 resistance line. The upside reversal in the RSI is currently endorsing the current bullish mood in the market, though the falling MACD suggests that the bulls will need to do some extra work to eliminate downside risks.

If the rise continues above the 20-day SMA, the door will open for the seven-and-half-year high of 184.00. The resistance line from May 2021 is within breathing distance at 184.70. Therefore, the price might need to crawl above it to meet the 2014-2015 limitations around the 186.00 number. Should buyers push higher, the next obstacle could develop within the 187.30-188.30 and then around 189.00.

On the downside, if the 179.80 floor collapses, there is potential for a negative correction towards the 50-day SMA at 178.00. A couple of trendlines are in the region, including the support trendline from March. Slightly lower, the constraining line that links the highs from April and October 2022 could be interesting to watch at 177.20. If sellers dominate there, the decline could pick up pace towards the 175.00-174.60 zone.

Summing up, GBPJPY is still in a neutral phase in the short-term picture, with traders waiting for a move above 182.00 or below 179.80 to drive the market accordingly.