Japanese Yen Edges Up Ahead of Inflation Report

USD/JPY

-0.06%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

- US employment claims expected to rise

- Japan’s core inflation projected to tick higher

- BoJ’s Ueda says no plans to tighten policy

The Japanese yen is trading quietly on Thursday. In the European session, USD/JPY is trading at 139.45, down 0.16%.

Japan’s core inflation expected to inch higher

Japan releases National Core CPI for June on Friday. The inflation indicator, which excludes fresh food, is expected to tick upwards to 3.3%, up from 3.2% in May. The “core-core” index, which excludes fresh food and energy and is closely watched by the Bank of Japan, is projected to dip to 4.2%, down from 4.3%.

Barring a major surprise, the inflation picture will remain pretty much the same after the June data is released. There is still pressure on the Bank of Japan to tighten policy, as inflation is expected to remain above the 2% target for a 15th straight month. This is making the BoJ’s argument that high inflation is temporary more difficult to swallow.

BoJ Governor Kazuo Ueda has been in office for several months and has essentially toed the line of the Bank’s ultra-loose monetary policy. Ueda said on Tuesday that the BoJ would continue this policy as there was “some distance to sustainably and stably achieving the central bank’s 2% inflation target”. Ueda’s comments were likely intended to dampen speculation about a shift in policy when the BoJ meets on July 28th.

We could see stronger movement from USD/JPY in the North American session when the US releases unemployment claims and the Philly Fed Manufacturing Index. The US labour market remains tight and any signs of cooling could raise expectations that the Fed will ease policy, which would be bearish for the US dollar. Unemployment claims are expected to rise slightly to 242,000, up from 237,000.

The manufacturing sector has been sputtering and the Philly Fed Manufacturing Index has declined for ten consecutive months. The consensus for June stands at -10, following -13.7 in May.

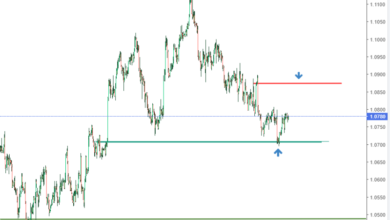

USD/JPY Daily Chart

USD/JPY Daily Chart

USD/JPY Technical

- There is resistance at 139.68 and 140.16

- USD/JPY is putting pressure on support at 138.97. The next support line is 137.75