USD/JPY: Yen Steady as Japanese Inflation Dips

USD/JPY

0.00%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DX

+0.15%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

- Japanese core inflation falls to 2.5%, as expected

- US to release PCE Price Index on Friday

The Japanese yen is showing little movement on Friday. In the European session, USD/JPY is trading at 142.03, down 0.06%.

Japanese Core Inflation Eases to 2.5%

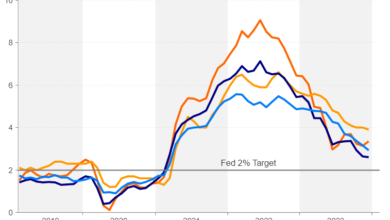

Japan’s Core CPI, which excludes fresh fuel but includes fuel costs, dropped to 2.5% in November, matching the consensus estimate. This was down from the October gain of 2.9% and marked the lowest reading since July 2022. Still, it was the twentieth consecutive month that the core rate has exceeded the Bank of Japan’s target of 2%. The headline figure dropped to 2.8%, down from 3.3% in October.

The yen shrugged off the drop in inflation, taking a breather after surging 1% a day earlier. The sharp gains were driven by the third-estimate US GDP for Q3, which came in at 4.9%, lower than the second estimate of 5.2%. The drop in GDP was driven by weaker consumer spending, but the economy remains strong, as the 4.9% gain was the highest level since Q4 2021.

The BoJ released on Friday the minutes of its October 31 meeting, when the central bank unexpectedly tweaked its yield curve control (YCC) program. The yen took a bath and fell 1.78% on the day of the meeting, as the markets viewed the move as a step by the BoJ’s to phasing out its ultra-easy monetary policy. The minutes indicated that board members were divided on whether the BoJ should make clear that the tweak was not a step towards ending YCC, or should the Bank “not strongly deny” that the tweak could lead to an end of YCC. The debate highlights that board members are well aware that a shift in policy can have a significant impact on the currency markets, as was evident with the yen’s plunge following the October meeting.

The US wraps up the week with the PCE Price Index, which is considered the Federal Reserve’s preferred inflation indicator. The headline and core readings are expected to remain unchanged in November, at 0.2% and 0%, respectively. Recent inflation readings have had a strong impact on the movement of the US dollar, and that could be the case later today if the headline or core rate readings are wide of the estimates. USD/JPY-4-Hour Chart

USD/JPY-4-Hour Chart

USD/JPY Technical

- USD/JPY has support at 141.57 and 141.03

- There is resistance at 142.60 and 143.14